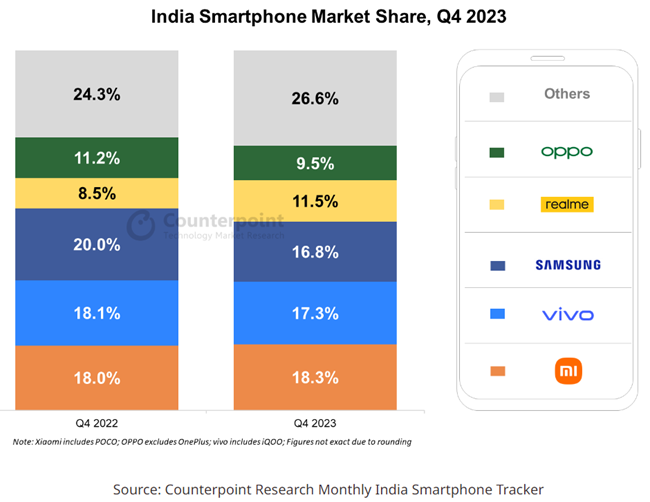

According to Counterpoint’s Monthly India Smartphone Tracker, India’s smartphone shipments witnessed a 25% YoY growth in Q4 2023, bouncing back after a year-long decline.

The overall figure for 2023 remained constant at 152 million units, with the first half being challenging due to low demand and inventory buildup. The market recovered in the second half, driven by 5G upgrades and robust festive sales.

5G Focus and Shipment Trends

Senior Research Analyst Shilpi Jain noted that many OEMs focused on bringing 5G to the lower segment, resulting in a 66% YoY growth, with the 5G smartphone shipment share crossing 52% in 2023.

The last quarter exited with healthy inventory levels, setting a positive tone for next year’s expected 5% YoY growth.

Market Dynamics and Predictions

The market is predicted to grow next year, fueled by premiumization, increased 5G availability in lower price bands, and improved macroeconomic conditions.

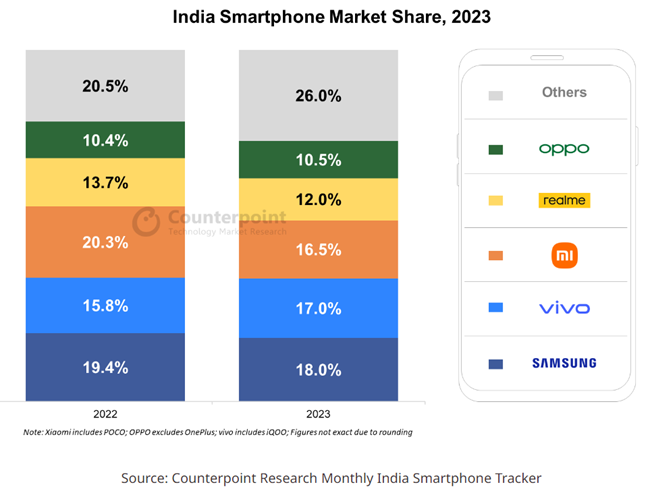

- The competitive landscape analysis highlighted Samsung leading with an 18% market share in 2023, followed by vivo at 17%, and Xiaomi at the third spot.

- The premium segment (>INR 30,000, ~$360) saw a 64% YoY growth in 2023, driven by easy financing schemes.

Apple’s Remarkable Performance

Apple surpassed 10 million units in shipments, securing the top revenue position in a calendar year for the first time. The company’s focus on India, combined with its retail strategies and attractive trade-in values, contributed to its success.

Offline Channel Growth

Offline channels grew to a 55% share in 2023, driven by consumers’ preference for the ‘look and feel’ of devices. The trend is expected to continue in 2024 due to premiumization, increased trade-ins, and more financing options.

Trends and Insights for 2024

- OEMs will focus on CMF (Colour, Material, Finish) across different price points.

- Audio-video enhancements in smartphones, featuring Dolby Atmos and Dolby Vision, are expected to become more prominent.

- Foldable devices will gain popularity in the premium segment, with shipments predicted to exceed 1 million in 2024.

- Notable brands like OnePlus, Transsion brands, Google, Lava, and Motorola experienced significant growth in 2023.

Commenting on the report, Senior Research Analyst, Shilpi Jain, said:

Fueled by the expansion of the premium segment and the adoption of 5G technology, the Indian smartphone market witnessed a 25% YoY growth in Q4 2023, rebounding from a year-long decline.

The extended festive season played a crucial role in supporting this growth, with the presence of substantial discounts, accessible financing options, and enticing promotions amplifying consumer demand.