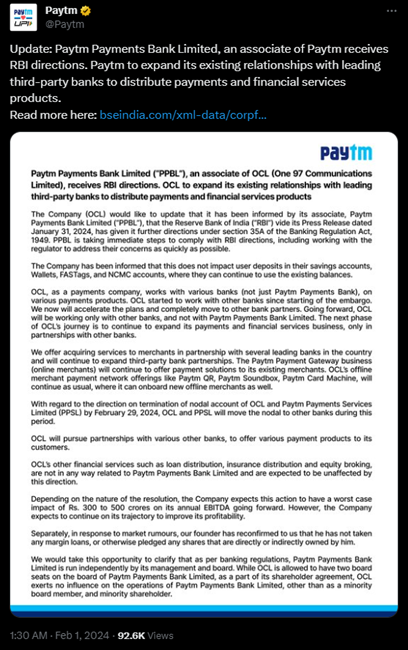

Paytm, today, has announced changes in response to the Reserve Bank of India’s (RBI) recent directions. Paytm Payments Bank Limited (PPBL), an associate of One 97 Communications Limited (OCL), has received specific instructions from the RBI under section 35A of the Banking Regulation Act, 1949.

Immediate Compliance Steps by PPBL

PPBL is taking immediate steps to comply with RBI directives and is collaborating with the regulator to address concerns promptly. Users can continue using their existing balances without disruption.

The company emphasizes that these changes will not impact user deposits in their savings accounts, wallets, FASTags, and NCMC accounts.

OCL’s Shift to Other Banks

OCL, as a payments company, has been working with various banks beyond PPBL. OCL began diversifying its partnerships from the start of the embargo and will now accelerate these plans.

Going forward, OCL will exclusively collaborate with other banks, excluding Paytm Payments Bank Limited.

Continuation of Services and Partnerships

Despite the changes, OCL reassures merchants that its Paytm Payment Gateway business for online transactions will continue offering solutions to existing merchants.

OCL’s offline merchant payment network, including Paytm QR, Paytm Soundbox, and Paytm Card Machine, will also continue as usual. OCL plans to onboard new offline merchants and expand partnerships with third-party banks.

In response to the RBI’s direction to terminate nodal accounts of OCL and Paytm Payments Services Limited (PPSL) by February 29, 2024, both entities will transition nodal accounts to other banks during this period.

Impact on Financial Services and Future Plans

OCL’s other financial services, such as loan distribution, insurance distribution, and equity broking, are unrelated to Paytm Payments Bank Limited and are expected to remain unaffected.

The company anticipates a worst-case impact of Rs. 300 to 500 crores on its annual EBITDA going forward, depending on the resolution’s nature. However, OCL remains committed to improving profitability.

Founder’s Clarification on Shares and Banking Regulations

Addressing market rumors, Paytm’s founder has confirmed that he has not taken any margin loans or pledged any shares directly or indirectly owned by him.

Additionally, the company emphasizes that Paytm Payments Bank Limited operates independently, with OCL exerting no influence on its operations beyond its role as a minority board member and shareholder.