The India smartphone market witnessed a slight growth of 1% YoY in 2023, shipping a total of 146 million smartphones as reported by the International Data Corporation (IDC).

The market experienced a significant shift in momentum with a sharp 10% decline in the first half, followed by an 11% YoY growth in the second half, driven by several new model launches. The fourth quarter of 2023 saw a remarkable 26% YoY growth with 37 million units shipped.

Consumer Trends and Average Selling Price

Despite price corrections and vendor schemes, excess inventory levels persisted across channels. The average selling price (ASP) reached a record high of US$255, marking a 14% YoY increase in 2023, driven by a surge in premium segment demand and a rapid adoption of 5G technology, which captured 55% of the market share.

Online channel shipments experienced a 6% decline, dropping to a 49% share in 2023, while offline channel shipments grew by 8% YoY. Vendors expanded their retail presence into smaller towns and cities, offering attractive premium products.

Key Highlights for 2023

Online channel shipments dropped by 6%, while offline channel shipments grew by 8%. Xiaomi led entry-level sales, with POCO and Samsung also strong.

- Mass budget segment (US$100<US$200) saw a decline, with vivo, Realme, and Samsung holding 53% market share.

- Entry-premium segment (US$200<US$400) remained stable, dominated by vivo and OnePlus with nearly 40% of shipments.

- Apple led the premium segment (US$600<US$800) with 68% share; Samsung followed with 30%. Super-premium segment (US$800+) grew by 86%, driven by Apple and Samsung.

5G and Foldable smartphones

79 million 5G smartphones shipped, with mass-budget and entry-premium segments growing. Popular models included iPhone 13 & 14, Galaxy A14, vivo’s T2x, and Xiaomi’s Redmi 12.

Almost a million foldable phones shipped, with Samsung leading but facing increased competition from Motorola, Tecno, OnePlus, and OPPO.

MediaTek-based smartphones captured 50% market share, with vivo’s T2x, Xiaomi’s Redmi A2, and Realme’s C55 being popular. Qualcomm’s share declined to 25%.

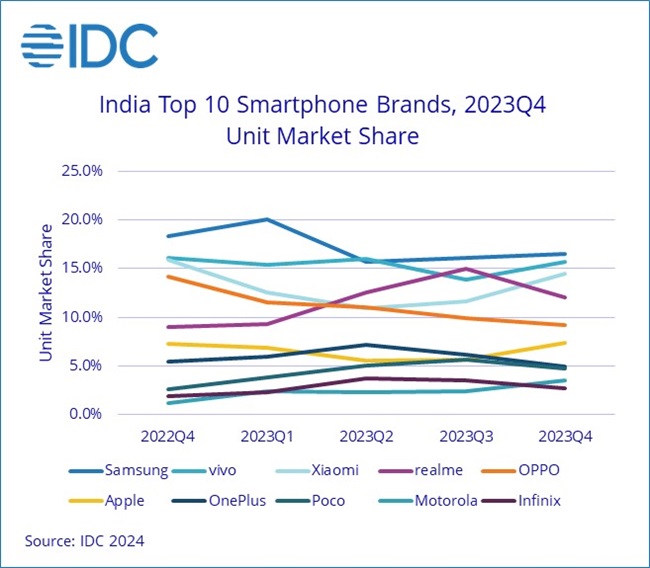

Brand Performance 2023

Apple: Shipped 9 million units in 2023 despite the highest ASP of US$940. This was propelled by previous generation iPhone models and local manufacturing efforts. iPhone 13/14 models ranked among the top 5 shipped devices for the year.

Samsung: Maintained its leadership with a record high ASP of US$338. Despite a 5% decline in shipments year-over-year, Samsung’s Galaxy A14 emerged as the highest shipped device in 2023.

vivo: Excluding iQOO, climbed to the second position with an 8% increase in shipments and a 9% increase in ASP. It was the sole brand among the top five to achieve growth.

realme: Held onto its third position, overcoming initial hurdles with the launch of budget-friendly smartphones.

Feature Phones in 2023

Witnessed an 8% year-over-year growth after four years of decline, shipping 61 million units. Transsion led this segment, followed by Lava.

The entry of Reliance Jio’s new 4G feature phone contributed to growth in the second half of 2023.

Outlook for 2024

Recovery for the smartphone market in 2024 faces challenges due to economic worries, inflation, and inventory issues. While 2023 focused on affordable 5G devices and price adjustments, 2024 will require additional efforts, especially in the entry-level segment, to drive growth.

Navkendar Singh, AVP of Client Devices Research at IDC India, predicts flat to low single-digit growth in 2024, mainly driven by upgraders in the US$200 to US$400 segment, supported by financing options and upgrade programs.

Commenting on the market dynamics of 2023, Upasana Joshi, Research Manager, Client Devices, IDC India, said:

Most brands opted to lower prices and provide supplementary channel margins in the final quarter to address inventory levels following a post-festive cyclic dip. As a result, we anticipate a tepid beginning to 2024, characterized by cautious stocking among channels.