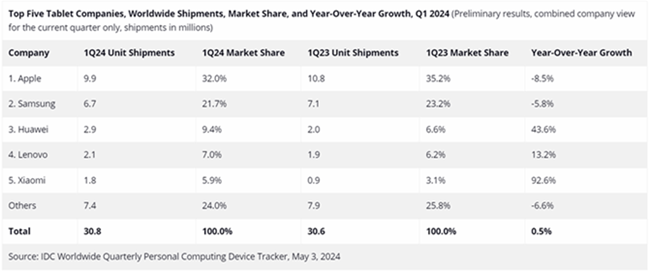

Worldwide Tablet shipments in the first quarter of 2024 saw a slight increase of 0.5%, totaling 30.8 million units, according to IDC’s preliminary data. This growth followed a decline lasting over two years since the second quarter of 2021, mainly due to market saturation.

Despite ongoing economic challenges, IDC notes that the increase in shipments this quarter was driven by the beginning of a refresh cycle, though it’s unlikely to match the peak levels seen during the pandemic.

Despite the overall market trend, there’s a shift towards premium tablets as consumers seek productivity-focused devices. Notably, Tablet shipments worldwide declined by 17.4% year-over-year in Q4 2023.

Key company highlights for Q1, 2024:

- Apple faced an 8.5% decline in shipments compared to the previous year, primarily due to economic conditions and the absence of new models. The company aims to clear older inventory before launching new models in 2Q24.

- Samsung, ranking second, experienced a 5.8% decline in shipments, influenced by competitive promotions and a lack of new products. The company focuses on enhancing user experience and promoting premium products.

- HUAWEI maintained its third position, achieving a remarkable 43.6% year-over-year growth with 2.9 million units shipped. The resurgence of its smartphone business likely contributed to this growth.

- Lenovo, in fourth place, saw a 13.2% increase in shipments. The Tab P series drove growth in detachable models, although slate tablets still dominate their shipments.

- Xiaomi retained its position in the top 5 with an impressive 92.6% year-over-year growth, shipping 1.8 million units. The company saw significant growth outside its largest market, China, across various regions.

Speaking on the current market dynamics, Anuroopa Nataraj, Senior Research Analyst at IDC’s Mobility and Consumer Device Trackers, commented:

The tablet market is exhibiting early signs of recovery in the first quarter. The true momentum will likely build during the upcoming refresh cycle, particularly with increasing tablet usage in education and the gig economy within commercial segments.

Nevertheless, challenges persist as competition from PCs and smartphones continues to impact the tablet market’s growth trajectory. However, there remains potential for growth, especially with the integration of AI capabilities, mirroring trends seen in other device categories.